Candlestick Pattern charts are important tools for buyers, which offer insight into market moves and pricing features. In this manual, we can destroy the entirety had to learn about analyzing the candlestick chart quickly and successfully.

Understand candlestick diagram:

A candlestick represents value movements within a particular time limit. Each candlestick has two main parts:

The Body (Real Body): Shows the difference between the opening and closing price.

The Wicks (Shadows or Tails): Indicate the highest and lowest prices reached during the time frame.

Bullish vs recession light:

Green candlesticks (bellows): The closing price is more than the original value, which means the price has been valued.

Red candlesticks (recession): The closing price is less than the opening value, and the price indicates depreciation.

For green lights:

- The opening value is at the bottom of the body.

- The closure value ** at the top of the body.

For red lights:

- The opening value ** is at the top of the body.

- The closure value ** is at the bottom of the body.

The top week represents the highest value, while the lower week represents the lowest price during the time period.

Candlestick Size Importance:

- Big candlestick body: indicates strong speed in the market.

- Small candlestick body: Suggestions for weak speed or indifference.

- Doji Candlestick: appears when the prices of openings and closure are almost the same, signaling market industries.

Why candlestick chart means something:

Candlestics tells a story about what buyers and sellers are doing in a special moment. Merchants analyze candlestick patterns to make informed business decisions based on price actions.

Analysis of candlesticks -diagram in real -time:

Let’s use this knowledge on a real stock map, using Apple (AAPL) inventory as an example.

1. Understanding Time Frames:

– 1D (Daily) means each candlestick represents one day.

– 1W (Weekly) means each candlestick represents one week.

– 1H (Hourly) means each candlestick represents one hour.

2. Reading Prices:

– The price of the beginning of the bottom and the closure course at the top appears to be under the green candle.

– The starting price at the top and the closed value at the top is displayed by hovering on a red candle.

– The highest and lowest fees can be observed at the ends of Vicks.

For instance, January 6, Apple opened on $126.05 and closed on $129, which changed into valued by means of $356. The highest fee had reached $130 and the lowest reached $124.90.

Identifying Market Trends

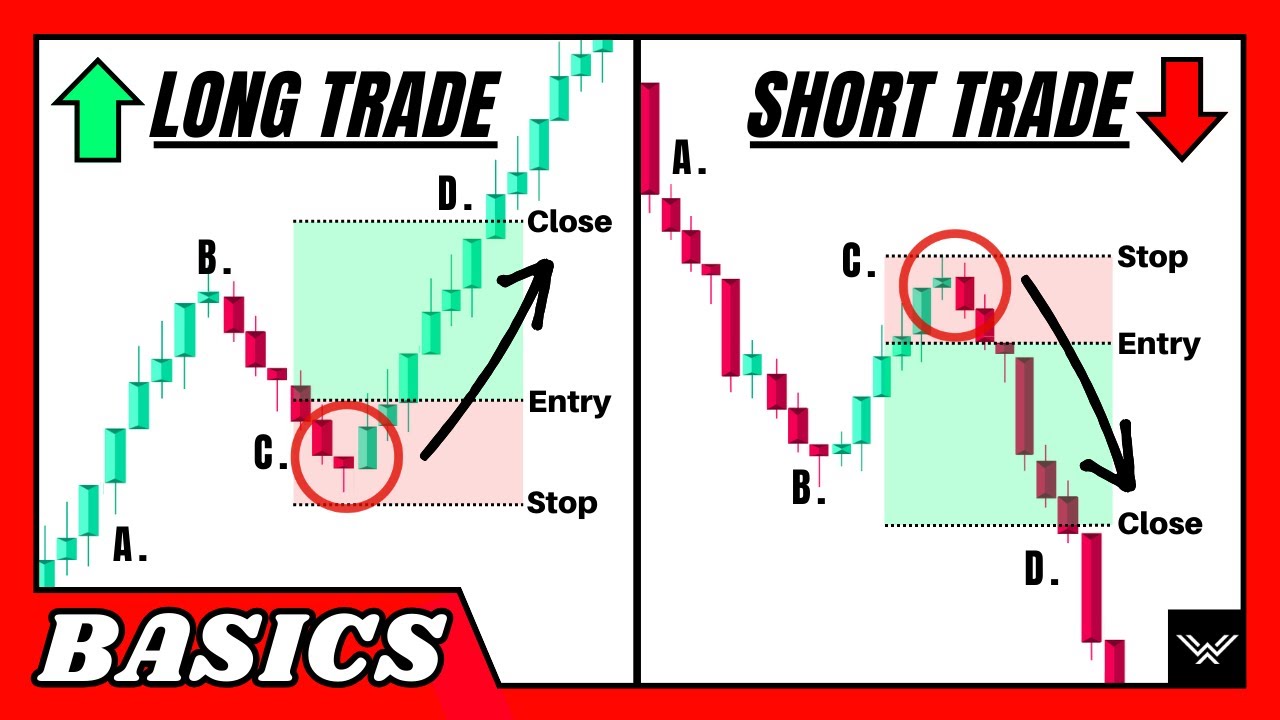

Uptrend (Bullish Market)

- More green candles than red candles** indicate price appreciation and bullish momentum.

- Higher highs and higher lows** confirm an uptrend.

- Traders typically look for long (buy) positions.

Downtrend (Bearish Market)

- More red candles than green candles** indicate price depreciation and bearish momentum.

- Lower highs and lower lows** confirm a downtrend.

- Traders typically look for short (sell) positions.

Sideways Market (Consolidation)

- A mix of red and green candles with no clear direction indicates indecision.

- The value moves within an area, which is suitable for both buying and selling goods.

Identify trend reversal

Upgraded to reversal

- A low shape after a series of high and high climbing.

- A low form before the price goes down.

Dowstrand to increase reversal

- A High shape after a series of lower and lower climbing.

- A High low shape before the price breaks.

Identifying Momentum Changes:

Momentum Gain:

- Tight price movement: Buyers or sellers are in full control, with little price fluctuation.

- Candles growing in size: Indicates strong momentum in a particular direction.

Momentum Loss

- Wide swings after tight movement: Shows a loss of control and possible reversal.

- Shrinking candles: Suggests a weakening trend.

- Color change: A shift from consecutive green to red (or vice versa) indicates potential momentum loss.

Final Thoughts

Candlestick charts offer buyers with precious insights into marketplace sentiment and charge movement. By gaining knowledge of candlestick analysis, you could make higher trading choices and assume marketplace traits successfully.

For extra buying and selling insights, visit our internet site at [ystrade.Com](https://ystrade.Com) and follow us on Instagram at @yStreet. Don’t neglect to hit the like button and subscribe for more free trading content material!