Introduction

Options trading is one of the most popular and versatile financial instruments in the stock market. While stocks represent ownership in a company, options are contracts that allow traders to speculate on the price movement of an asset without actually owning it. Many investors use options to hedge risks, generate income, or leverage their capital for higher returns.

In this article, we will break down options trading into simple terms, explaining how it works, its key components, and the potential risks and rewards involved.

What Are Options?

An option is a contract between two parties that grants the buyer the right, but not the obligation, to buy or sell an asset at a predetermined price within a specific time frame. The asset can be stocks, commodities, indices, or even currencies.

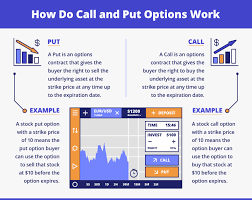

There are two main types of options:

- Call Options – These give the buyer the right to buy an asset at a fixed price before or on the expiration date.

- Put Options – These give the buyer the right to sell an asset at a fixed price before or on the expiration date.

Understanding Options Contracts

Each options contract has several key components:

- Strike Price – The agreed-upon price at which the asset can be bought (for a call) or sold (for a put).

- Expiration Date – The date on which the contract expires. The buyer must decide whether to exercise the option before this date.

- Premium –The cost the buyer pays to the seller to acquire the option contract. This is the cost of the contract.

- Underlying Asset – The asset the option is based on, such as a stock, index, or commodity.

Example: How an Options Contract Works

Let’s say an investor, Alex, believes that Tesla’s stock price will rise in the next three months. However, instead of buying Tesla shares, Alex buys a call option with:

- Strike price: $165

- Expiration date: Three months from now

- Premium paid: $10 per share

At the end of three months, if Tesla’s stock price rises to $190, Alex can exercise the option to buy shares at $165 and immediately sell them for $190, making a profit of $25 per share ($190 – $165). However, after deducting the $10 premium paid, the net profit is $15 per share.

On the other hand, if Tesla’s stock price falls below $165, Alex will not exercise the option and will simply lose the $10 premium.

How Do Traders Profit from Options?

Options provide multiple ways for traders to make money:

- Buying and Selling Options (Speculation) – Traders can buy calls if they expect prices to rise or buy puts if they expect prices to fall. They can also sell options to collect premiums.

- Hedging – Investors use options to protect their portfolios from losses. For example, an investor holding stocks might buy a put option as insurance against a market downturn.

- Generating Income (Selling Options for Premiums) – Some traders sell options and collect the premium as income. This works well in stable markets where the option may expire worthless, allowing the seller to keep the premium.

Benefits of Options Trading

- Leverage – Options allow traders to control a large number of shares with a smaller investment compared to buying the stock outright.

- Flexibility – Traders can profit from rising, falling, or even sideways markets by using different strategies.

- Risk Management – Options can be used to hedge against losses in an investment portfolio.

Risks of Options Trading

- Time Decay – Options lose value as they approach expiration, meaning traders must act within a limited timeframe.

- Market Volatility – Prices can fluctuate unpredictably, making options riskier than traditional stock trading.

- Potential Losses – Buyers can lose 100% of the premium paid if the option expires worthless, while sellers face unlimited risks if the price moves significantly against them.

Conclusion

Options trading is a powerful tool for traders and investors looking to maximize profits, hedge risks, and diversify their strategies. While options offer numerous benefits, they also come with risks that require a good understanding of market behavior. Whether you’re a beginner or an experienced trader, learning how options work can open up new opportunities in the financial markets.

Understanding Options Trading: A Simple Guide

What Are Options?

Options are financial agreements that provide the buyer with the right, but not the obligation, to purchase or sell an underlying asset at a predetermined price within a specific period. These contracts establish an agreement between two parties: the buyer and the seller.

For this explanation, let’s take a look at options trading from the buyer’s perspective, using an example to clarify how it works.

Understanding Call Options

A call option gives the buyer the right to purchase a stock at a specified price (known as the strike price) within a set period.

Let’s consider an example using Yelp stock. Suppose Yelp’s current stock price is $35.84 per share. For simplicity, we round this up to $36.

Now, imagine I offer you the option to buy Yelp at $38 per share anytime within the next 30 days. However, to secure this right, you must pay me a premium of $0.80 per share.

Is This a Good Deal?

Determining whether this is a good deal depends on the stock’s future price movement. If the stock price increases above the strike price, you stand to make a profit. If the price remains the same or decreases, the contract may not be beneficial.

Let’s assume you purchase the call option for $0.80 per share. You now have the right to buy Yelp at $38 per share within 30 days.

How You Make a Profit

If Yelp’s stock price rises to $42 per share within the 30-day period, you can use your call option to buy the stock at $38 per share. Since the market price is $42, you can immediately sell it at this higher price and pocket the difference.

Here’s how the profit calculation works:

- Purchase price (strike price): $38 per share

- Selling price: $42 per share

- Profit per share: $42 – $38 = $4 per share

- Premium paid: $0.80 per share

- Net profit per share: $4 – $0.80 = $3.20 per share

If you bought 100 contracts (since each option contract represents 100 shares), your total profit would be:

- $3.20 x 100 = $320

What Happens If the Stock Price Falls?

If the stock price remains below $38 or declines, you would not exercise the option because you could buy the stock at a lower price on the open market. In this case, your only loss would be the premium paid ($0.80 per share), which is the price of securing the option.

Conclusion

Options trading offers a way to speculate on stock price movements without actually owning the stock. While call options provide an opportunity for profit when prices rise, they also come with risks, as you can lose the premium paid if the stock price does not move favorably. Understanding the mechanics of options trading is essential before engaging in it, as it requires careful planning and risk management.