Trading can be highly rewarding, but it’s also an area where many beginners face significant challenges. Mistakes often stem from emotions, inexperience, or poor risk management, all of which can derail a trader’s success. In this article, we’ll break down three critical mistakes to avoid and how to overcome them.

- Trading with Emotion

A fundamental rule for any trader, especially beginners, is to never trade with emotion. While this is easy to say, it’s much harder to execute. Emotions often lead to impulsive decisions, which can be detrimental to trading success.

Recognizing Emotional Traps

Many trading mistakes, such as chasing trades or overtrading, stem from emotional responses. Imagine you’ve identified a resistance level on a stock chart, planning to enter once the price crosses it. However, while monitoring other stocks, the price suddenly skyrockets past the resistance.

An inexperienced trader might feel compelled to jump in, fearing they’ll miss the opportunity for profit. They enter at a much higher price, exposing themselves to significant risk. The result? They buy near the peak, only to see the price drop shortly after.

The Solution: Stick to Your Plan

A professional trader, in contrast, recognizes this as a missed opportunity. Instead of chasing the trade, they move on to the next setup or wait for a price pullback to re-enter at a lower-risk point. The key is to adhere to your strategy and resist emotional impulses. If you’re late to the trade, accept it and focus on the next opportunity.

- Overcommitting Capital

One of the most dangerous mistakes new traders make is using too much money on a single trade. Let’s say you start trading with $100 per trade and find consistent success, making $500 over a week. Encouraged by this success, you decide to increase your position size to $1,000 per trade, hoping to multiply your profits.

Why Overcommitting is Risky

While the idea seems logical, it introduces a new level of emotional pressure. If $1,000 is a significant portion of your account, any unfavorable price movement can trigger panic. Watching your balance drop quickly might cause you to make hasty decisions, like selling prematurely or holding onto losing trades out of fear.

The Solution: Trade Within Your Comfort Zone

Always trade with an amount you’re comfortable losing. This approach minimizes emotional stress and helps you maintain discipline. Trading is not about getting rich quickly—it’s about growing your account steadily and consistently. The sooner you embrace this mindset, the sooner you’ll achieve long-term profitability.

- Not Using Stop-Loss Orders

Failing to set stop-loss orders is another common mistake that can lead to significant losses. Stop-loss orders automatically close a trade if the price moves against you beyond a predetermined level, helping to limit your losses.

The Cost of Neglecting Stop-Losses

Imagine entering a trade with confidence, convinced the stock price is about to soar. Excitement and greed cloud your judgment, and you skip setting a stop-loss. Suddenly, the market takes an unexpected turn, and the stock price plummets. Without a stop-loss in place, you’re left scrambling to exit the trade, often at a much worse price than anticipated.

The Solution: Always Set Stop-Losses

Even if you’re trading long-term or using swing strategies, identify a point on the chart where you’ll exit if the price falls below a certain level. This disciplined approach protects your capital and ensures you’re not at the mercy of unexpected market movements.

Building Better Trading Habits

Avoiding these common mistakes requires discipline, education, and a solid trading plan. Here are some tips to strengthen your approach:

- Practice Patience: Wait for the right setups and avoid rushing into trades.

- Manage Risk: Use proper position sizing and risk management strategies to protect your account.

- Learn Continuously: Stay informed about market trends, strategies, and tools to enhance your trading skills.

- Review Your Trades: Analyze your trades to identify patterns, mistakes, and areas for improvement.

By focusing on these fundamentals and avoiding common pitfalls, you can set yourself on a path to becoming a successful trader.

Top of Form

Bottom of Form

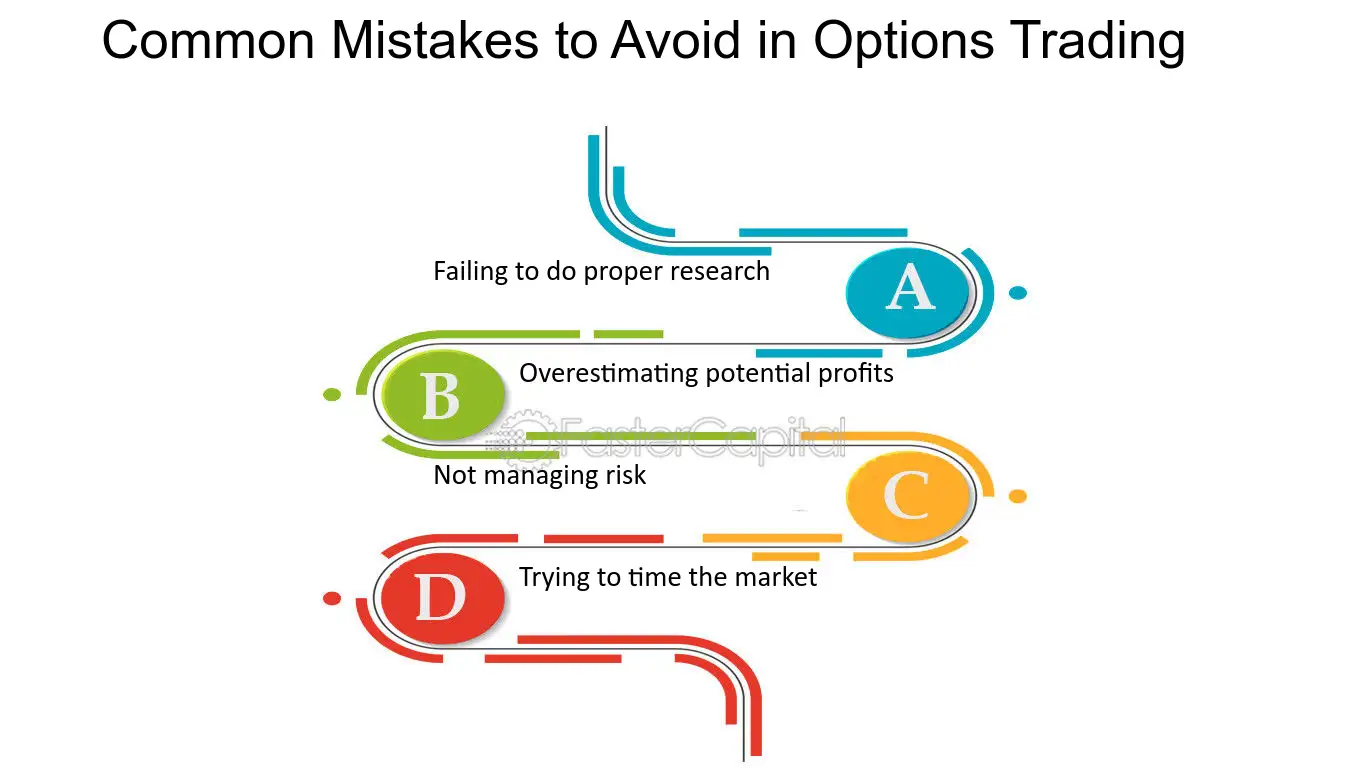

Options trading can be an exciting and profitable endeavor, but it is also a domain where traders often make costly mistakes. To succeed, it’s vital to understand the pitfalls that can derail even the most experienced traders. This article outlines six common mistakes to avoid and provides strategies to enhance your options trading performance.

- Neglecting Proper Education

One of the biggest mistakes traders make is diving into options trading without a solid understanding of how it works. Options are complex financial instruments with unique risk and reward structures. Misunderstanding key concepts like strike prices, expiration dates, implied volatility, and the Greeks (delta, gamma, theta, vega) can lead to poor decisions.

How to Avoid This:

Invest time in learning the fundamentals. Read books, take online courses, and practice with virtual trading accounts to build a strong foundation before risking real money.

- Failing to Develop a Trading Plan

Trading without a clear plan is a recipe for disaster. Many traders approach options with a “buy and hope” mentality, failing to define their goals, risk tolerance, or strategies. Without a plan, emotions can take over, leading to impulsive decisions and significant losses.

How to Avoid This:

Create a comprehensive trading plan that includes:

- Entry and exit strategies

- Risk management rules (e.g., stop-loss and profit targets)

- Position sizing based on your account size

- A defined strategy, such as covered calls or iron condors

Review and refine your plan as you gain experience.

- Ignoring Implied Volatility

Implied volatility (IV) plays a crucial role in options pricing, yet many traders overlook its importance. Buying options with high IV often results in overpaying, especially if volatility decreases after the trade, leading to losses even when the stock moves in the expected direction.

How to Avoid This:

Analyze implied volatility before entering trades. Look for opportunities to buy options with low IV and sell options with high IV. Tools like the Implied Volatility Percentile (IVP) can help you determine whether IV is high or low relative to historical levels.

- Overleveraging Positions

Options allow traders to control large amounts of stock with relatively small amounts of capital. While this leverage is appealing, it can also amplify losses. Many traders take on oversized positions, exposing themselves to undue risk and jeopardizing their accounts.

How to Avoid This:

Practice proper position sizing. Limit the amount of capital allocated to any single trade, typically no more than 2-5% of your account value. This approach minimizes the impact of losses and preserves your ability to trade over the long term.

- Holding Positions Too Close to Expiration

While short-term options can offer high returns, holding positions too close to expiration increases risk significantly. Time decay accelerates as expiration approaches, and unexpected market moves can wipe out your position’s value in a matter of hours or days.

How to Avoid This:

Manage your trades proactively. Close positions well before expiration if the trade is not working in your favor, or consider rolling your position to a later expiration date to reduce time-related risk. Avoid speculative trades on short-dated options unless you fully understand the risks involved.

- Chasing the Market and Overtrading

Many traders fall into the trap of chasing market trends or trading excessively in an attempt to recover losses. This behavior often leads to poor decision-making and further financial setbacks. Overtrading can also result in higher commissions and fees, eating into your profits.

How to Avoid This:

Stay disciplined and stick to your trading plan. Avoid reacting emotionally to market moves or news events. Quality over quantity is key; focus on high-probability setups rather than trading for the sake of activity.

Conclusion

Options trading offers unique opportunities for profit but requires careful planning, discipline, and knowledge to avoid common mistakes. By prioritizing education, developing a solid trading plan, and respecting the nuances of implied volatility, traders can significantly improve their chances of success. Additionally, practicing risk management, avoiding excessive leverage, and resisting emotional trading can help preserve capital and ensure long-term profitability.

By learning from the mistakes of others and adopting a strategic approach, you can navigate the complexities of options trading and build a foundation for consistent growth in this dynamic market.