The Importance of Probability in Trading

In today’s discussion, we’ll focus on two key points:

- The Reality of Trading Success Rates

- Why Even an 80% Strategy Can Lead to Losses

Many traders fail to grasp the concept of probability, leading to unnecessary losses, even with profitable setups. This misunderstanding often stems from the belief that high-probability strategies guarantee success. Let’s break this down step-by-step.

The Sobering Truth About Trading

Recent reports from SEBI reveal a harsh truth:

- 90% of traders consistently incur losses.

- Of the remaining 10%, only 4-5% make significant profits.

This means the vast majority of people engaging in trading struggle to stay profitable. Many traders also fall into financial distress, which can result in extreme consequences, including mental health struggles and even suicide.

While this is heartbreaking, it highlights a critical need to approach trading with a realistic mindset. Trading, like any other business, comes with risks, and success requires discipline, strategy, and proper risk management.

Common Myths and Misunderstandings in Trading

- Trading to Escape a 9-to-5 Job

Many influencers or advertisements promote trading as a quick way to achieve financiExpectationsal independence or escape a job. This is misleading. Every profession, whether a job or trading, requires commitment and skill development. - Others’ Success

Looking at influencers or successful traders and expecting to replicate their results without understanding the work behind it is a recipe for disappointment. - High with Little Experience

Beginners often expect to earn lakhs within weeks of starting, leading to poor decision-making, over-leveraging, and heavy losses.

Why Even an 80% Strategy Can Fail

The Misconception:

An 80% win-rate strategy means that out of 10 trades, 8 will be successful. Many believe this guarantees consistent profits.

The Reality:

While an 80% strategy might be accurate in backtesting, in real trading:

- Market conditions vary.

- External factors like emotional decision-making, slippage, or poor risk management can lead to losses.

- Even with 80% accuracy, improper risk-to-reward ratios can wipe out gains.

Example with Virat Kohli:

Virat Kohli’s average batting score might be 50, but does that mean he scores 50 runs in every match? Absolutely not. Some matches may see him score 10, while others may see 100. The average is derived over time, not guaranteed in each instance. Similarly, a trading strategy’s success is an average performance over time, not a certainty for each trade.

Risk and Money Management: Key to Survival

Trading is not just about strategy; it’s about surviving long enough to thrive. Here’s how to approach it:

- Start Small

- Begin with small capital—₹5,000 or ₹10,000.

- Treat initial trades as learning experiences, not profit-making ventures.

- Set Realistic Expectations

- Avoid high-risk trades or expecting ₹1 lakh returns from ₹10,000 overnight.

- Understand that trading is a marathon, not a sprint.

- Risk-to-Reward Ratio

- Always aim for a favorable risk-to-reward ratio (e.g., risking ₹1 to make ₹2).

- Even with a 50% win rate, this ratio ensures long-term profitability.

- Focus on Mental Preparation

- Trading requires emotional discipline and a clear mind.

- Be prepared for losses and avoid risking money you can’t afford to lose.

Practical Tips for Beginners

- Paper Trading

- Practice strategies in a simulated environment without risking real money.

- Learn Slowly

- Start with stocks or ETFs instead of complex options or futures.

- Gradually move to advanced instruments as you gain experience.

- Avoid Leverage Initially

- Trading with leverage amplifies both gains and losses. Until you master risk management, avoid over-leveraging.

- Stick to a Plan

- Develop a trading plan with clear entry and exit points.

- Maintain discipline and follow the plan, even in emotionally charged situations.

Understanding Influencer Misrepresentation

Many influencers and traders show high profits but fail to disclose yearly statements. This can mislead beginners into believing consistent profits are easy to achieve. The truth is:

- Most influencers rely on multiple income streams.

- Even experienced traders have losing years.

Trading is a Tiring but Rewarding Process

Becoming a successful trader is not easy. Markets evolve constantly, requiring traders to adapt and refine their strategies. This process can be tedious, but with patience and discipline, it’s possible to succeed.

Final Takeaways

- Start Small and Learn

- Begin with minimal capital and focus on learning.

- Understand the Risks

- Trading is inherently risky

- Build Experience Gradually

- Spend 2-3 years practicing and understanding market dynamics.

- Don’t Fall for Shortcuts

- Avoid chasing unrealistic returns or following unverified advice.

Moving Forward: What’s Next?

In the next part of this series, we’ll discuss why traders lose even with 80% strategies and explore key concepts like:

- Probability and Averaging

- Risk-to-Reward Analysis

- Trader Psychology and Discipline

Remember: Trading is not just about strategy; it’s about mindset, discipline, and risk management. Stick to the process, and success will follow with time.

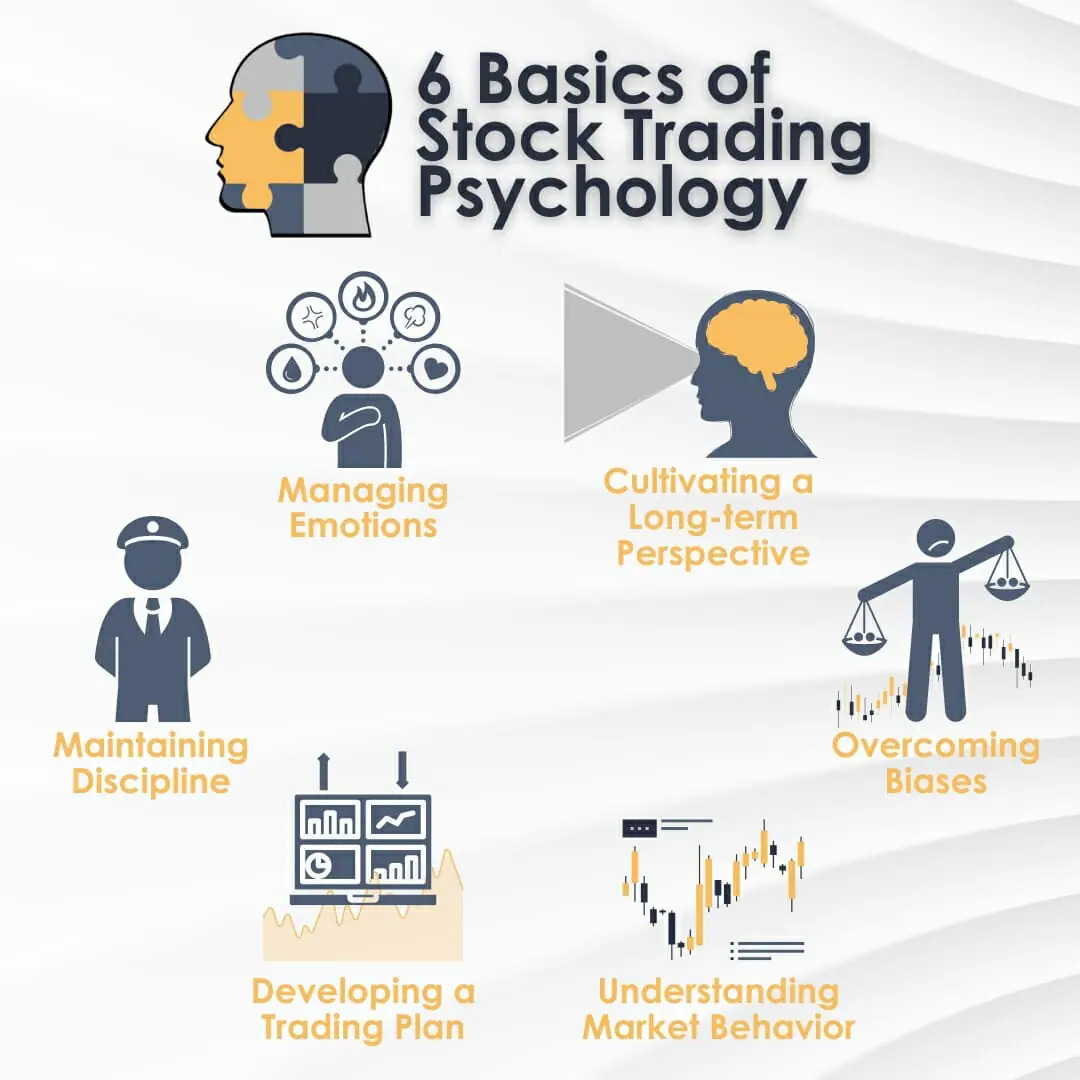

While technical and fundamental analysis are crucial for trading, psychological factors often determine long-term success. Trading involves high stakes, where fear, greed, and other emotions can cloud judgment.

Key Psychological Traits of Successful Traders:

- Discipline: Sticking to a plan regardless of external factors.

- Patience: Waiting for the right opportunity rather than forcing trades.

- Emotional Resilience: Handling losses and gains without letting them affect future decisions.

Trading psychology impacts how traders manage risk, handle pressure, and maintain consistency—all of which are essential for sustainable performance.

- Common Emotional Barriers in Trading

Understanding the emotional challenges faced by traders is the first step toward overcoming them.

- Fear

- Fear of Losing Money: Leads to hesitation in taking trades or exiting too early.

- Fear of Missing Out (FOMO): Causes traders to enter trades impulsively due to the fear of being left behind.

- Greed

- Overconfidence after a series of wins can lead to over-leveraging and taking unnecessary risks.

- Greed often blinds traders to logical exit points, causing them to hold onto trades longer than they should.

- Impulsivity

- Emotional decision-making often stems from impulsivity, which leads to inconsistent outcomes.

- Revenge Trading

- Trying to recover losses quickly can lead to reckless trades, compounding losses.

- Overconfidence

- After a series of wins, traders may underestimate risks and overextend their positions, leading to significant losses.

- The Science Behind Emotional Responses

To manage emotions effectively, traders must understand why they occur.

-

- Biological Factors

- Fight-or-Flight Response: Fear activates the brain’s amygdala, pushing traders to act instinctively rather than logically.

- Dopamine Hits: Winning trades release dopamine, reinforcing risky behavior over time.

- Cognitive Biases

- Loss Aversion: Traders feel the pain of a loss more intensely than the joy of an equivalent gain, leading to irrational decision-making.

- Confirmation Bias: The tendency to favor information that supports pre-existing beliefs, even if it’s flawed.

- Strategies to Overcome Emotional Barriers

Mastering trading psychology involves building mental fortitude and emotional intelligence. Here are practical strategies:

- Develop a Solid Trading Plan

- Outline clear entry, exit, and risk management rules.

- Stick to the plan regardless of market noise or emotional impulses.

- Practice Risk Management

- Only risk a small percentage of your capital per trade (commonly 1-2%).

- Keep a Trading Journal

- Document every trade, including the rationale, emotions, and outcomes.

- Analyze patterns in emotional behavior to identify areas for improvement.

- Use Visualization and Affirmations

- Visualize executing trades calmly and logically.

- Use affirmations to reinforce confidence and discipline.

- Take Breaks

- Stepping away from the screen after a streak of wins or losses helps reset your mindset.

- Avoid overtrading, as it often leads to impulsive decisions.

- Simulated Trading

- Use demo accounts to practice strategies without the pressure of real money.

- Build confidence and refine your psychological approach in a risk-free environment.

- Building Emotional Discipline

- Focus on the Process, Not the Outcome

- Success in trading isn’t about the results of a single trade but about the consistency of following your plan.

- Celebrate disciplined execution rather than just profitable outcomes.

- Accept Losses as Part of the Game

- Even the best traders incur losses.

- Shift your mindset to view losses as a cost of doing business.

- Develop Patience

- Wait for high-probability setups instead of chasing trades.

- Trust that the market will present opportunities over time.

- Stay Objective

- Separate emotions from trading decisions by focusing on data and analysis.

- Use alerts or algorithms to automate aspects of trading and reduce emotional influence.

- The Importance of Mental and Physical Well-Being

Trading is a demanding activity that requires peak mental and physical health. Ignoring well-being can exacerbate emotional challenges.

- Maintain a Healthy Lifestyle

- Eat nutritious meals, exercise regularly, and get enough sleep to keep your mind sharp.

- Avoid substances that can impair decision-making, such as caffeine in excess or alcohol.

- Manage Stress

- Balance trading with hobbies and social activities to avoid burnout.

- Build a Support System

- Connect with other traders to share experiences and learn from their challenges.